March 08, 2022: While listening to the State Bank of Pakistan (SBP) Governor Reza Baqir’s post-monetary policy announcement briefing, many of us were left wondering over the logic of some his arguments.

For starters, the governor says that the MPC is watching the non-oil current account deficit (CAD) and doing its utmost to squeeze it as it does not have much say in the oil part of the CAD. The SBP has been reiterating the same sentence for the last two monetary policy announcement diverting the observers’ attention towards the non-oil CAD. In the same breath, Reza Baqir also said that the SBP’s tools will unlikely have an impact on oil CAD since it is primarily driven by the price increase.

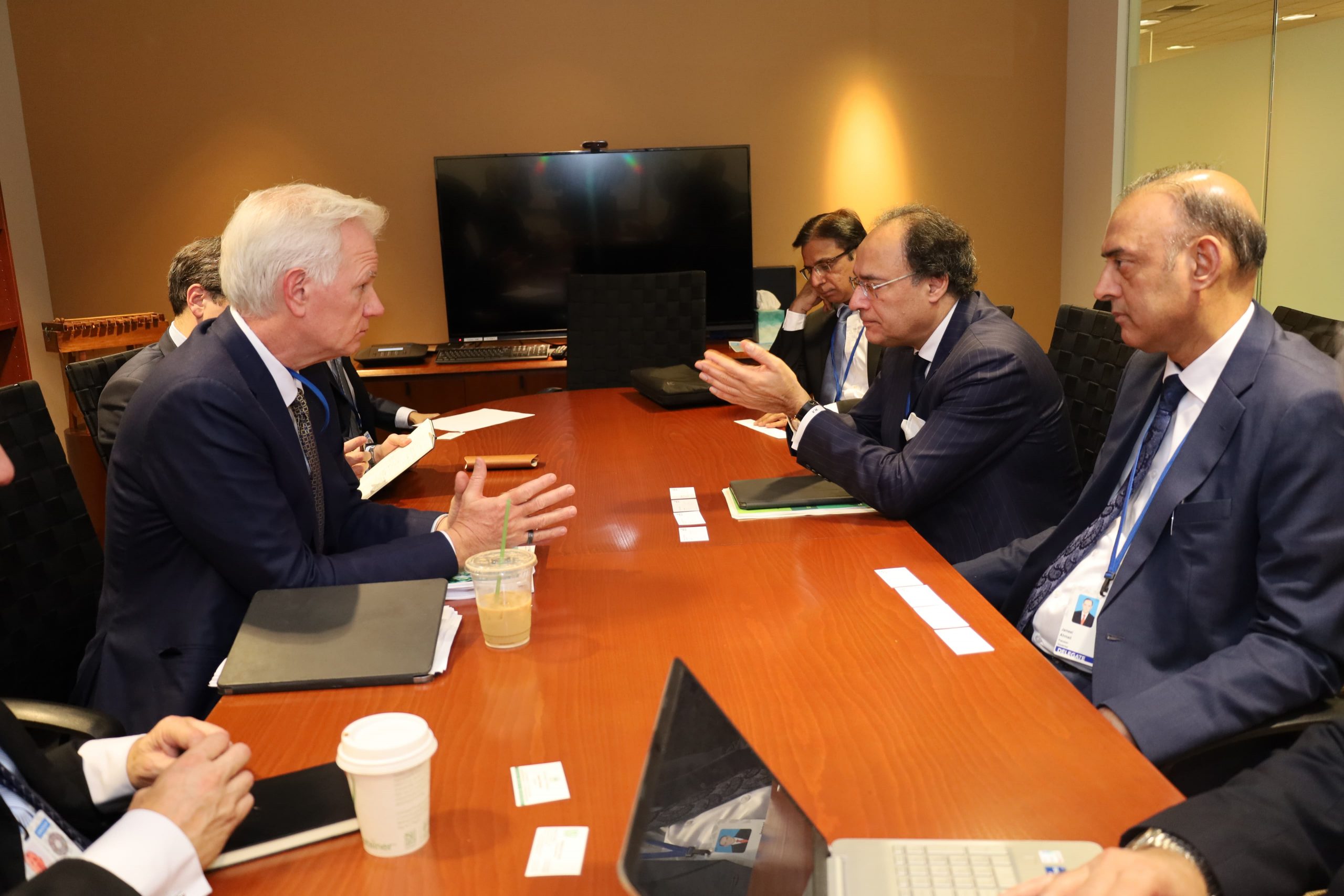

Adding to this, the Deputy Governor Murtaza Syed said the outlook for demand is moderating with the help of central bank’s intervention and government’s fiscal policies (which alternate between contractionary or expansionary every second month). Meanwhile, he also pointed out that the non-oil CAD is beginning to taper off.

But these arguments defy all logic. To say the CAD (including oil) is beyond SBP’s control while adding that the non-oil CAD has reduced because of SBP’s measures is illogical at best.

First, in terms of quantity imported, the oil bill in the 7MFY22 has jumped 25pc to 15.6MT. In dollar terms, the total oil import bill for petroleum products and crude oil is $8.5bn compared to $4.1bn in the corresponding period of last fiscal year. Around 15% of the increase in the oil import bill has been due to the rise in overall petroleum imports. The SBP, while on hand argues that it has moderated demand through stringent measures whereas on the other hand it has left the demand for fuel products grow unchecked.

These arguments defy logic. By carving out the CAD into overall and non-oil, it is trying to divert attention away from the failures of both itself and the finance ministry in containing demand.

Beyond this flawed logic of the same actions having different effects on high-frequency indicators, the monetary policy statement also has another nugget.

In its first paragraph, the monetary policy statement reads: “…. the MPC’s view [is] that the outlook for inflation has improved following the cuts in fuel prices and electricity tariffs announced last week as part of the government’s relief package. At the same time, high-frequency indicators suggest that growth continues to moderate to a more sustainable pace.”

So fuel price and electricity tariff cuts will have an impact on inflation but they would keep the demand in check? How does that make any sense?

Well, we guess we would never know. But what we do know is that the central bank invent a new metric out of the hat (in-kind imports, non-oil CAD) to put on a magic show that makes zero sense.

Copyright Mettis Link News