May 31, 2022 (MLN): Despite PKR gain of 3.5 rupees against the greenback in straight three days, the capital market witnessed a range-bound session on Tuesday where profit-taking was observed in the last hours mainly due to the higher expected inflation readings for May’22.

However, the positive hope of IMF program completion braced the index to close in a green zone, a market wrap by Pearl Securities cited.

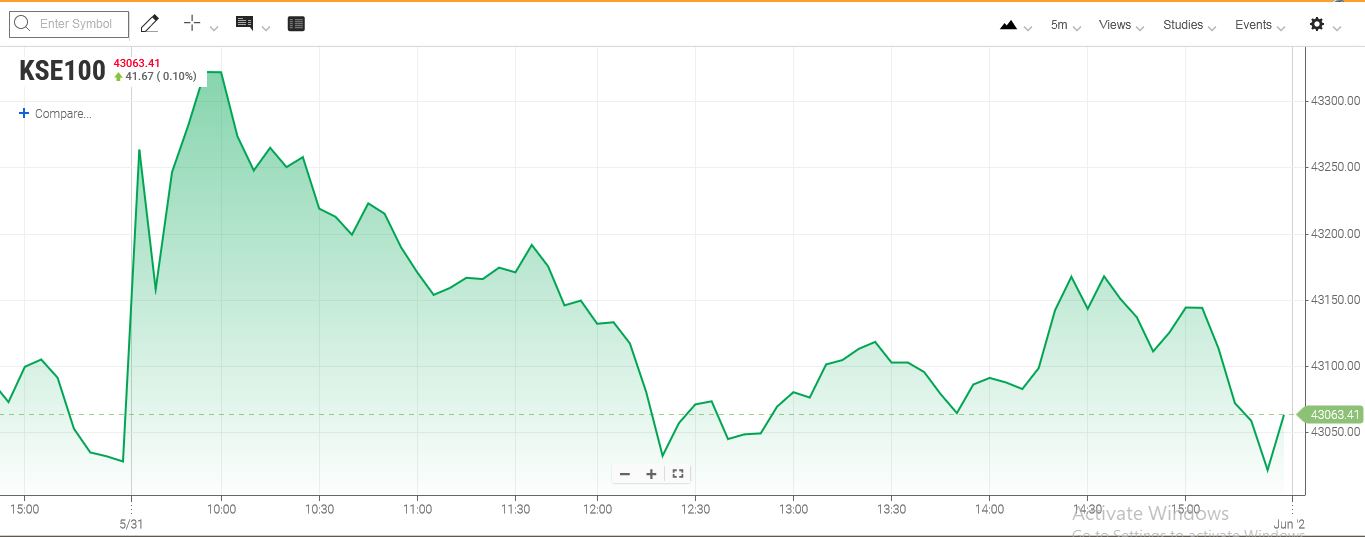

As a result, the benchmark KSE-100 Index made an intraday high of 43,341.79 to close at 43,078 level, up by only 38 points.

The Index traded in a range of 324.93 points or 0.75 percent of the previous close.

Of the 91 traded companies in the KSE100 Index 33 closed up 55 closed down, while 3 remained unchanged. The total volume traded for the index was 122.47 million shares.

Sectors propping up the index were Power Generation & Distribution with 64 points, Oil & Gas Exploration Companies with 57 points, Technology & Communication with 22 points, Automobile Assembler with 20 points and Fertilizer with 16 points.

The most points added to the index was by HUBC which contributed 67 points followed by MTL with 28 points, SYS with 26 points, POL with 25 points and OGDC with 17 points.

Sector wise, the index was let down by Cement with 68 points, Commercial Banks with 28 points, Pharmaceuticals with 10 points, Textile Composite with 9 points and Glass & Ceramics with 9 points.

The most points taken off the index was by LUCK which stripped the index of 47 points followed by MCB with 19 points, HMB with 10 points, SEARL with 9 points and EFERT with 9 points.

All Share Volume increased by 97.88 Million to 285.35 Million Shares. Market Cap decreased by Rs.7.73 Billion.

Total companies traded were 344 compared to 335 from the previous session. Of the scrips traded 147 closed up, 173 closed down while 24 remained unchanged.

Total trades decreased by 2,755 to 88,800.

Value Traded increased by 1.27 Billion to Rs.7.39 Billion

| Company | Volume |

|---|---|

| Silkbank | 71,621,000 |

| Pakistan International Bulk Terminal | 35,617,500 |

| Pakistan Refinery | 21,118,824 |

| Pak Elektron | 17,832,000 |

| Worldcall Telecom | 10,588,500 |

| Unity Foods | 8,014,788 |

| Flying Cement Company | 7,489,500 |

| Ghani Global Holdings | 6,737,055 |

| TPL Properties | 6,332,327 |

| Oil & Gas Development Company | 6,257,934 |

| Sector | Volume |

|---|---|

| Commercial Banks | 82,582,500 |

| Transport | 36,017,800 |

| Refinery | 28,251,961 |

| Technology & Communication | 22,161,343 |

| Cable & Electrical Goods | 20,116,250 |

| Food & Personal Care Products | 14,867,322 |

| Chemical | 13,199,260 |

| Cement | 12,168,355 |

| Oil & Gas Exploration Companies | 9,887,939 |

| Oil & Gas Marketing Companies | 8,283,613 |

Copyright Mettis Link News

33083