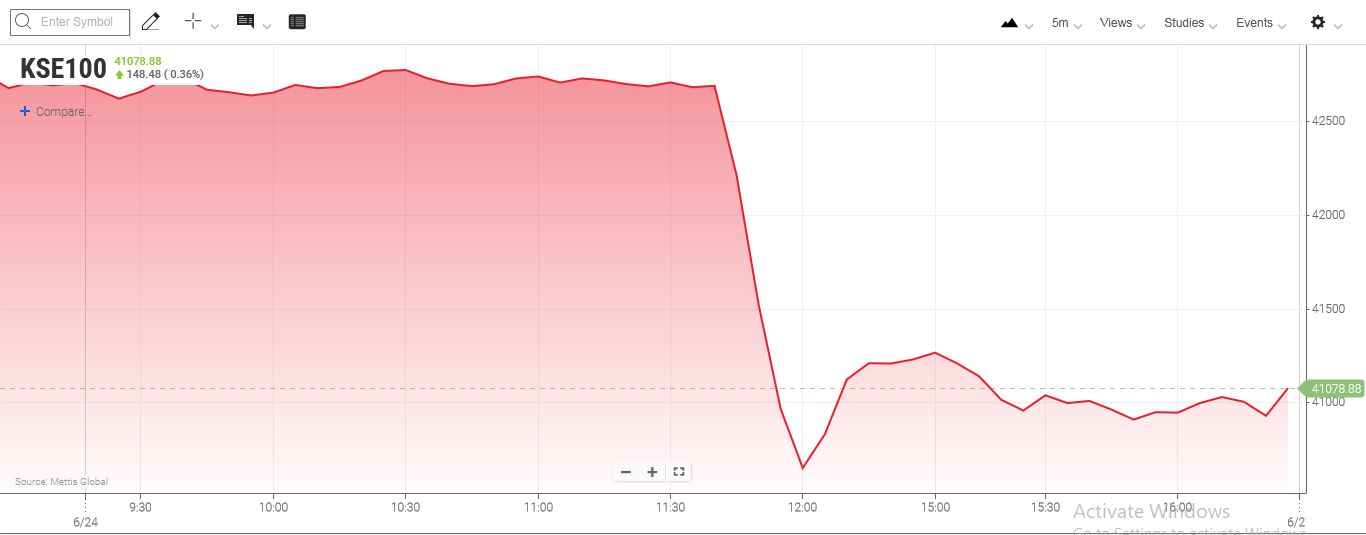

June 24, 2022 (MLN): Domestic equities witnessed huge selling pressure after the announcement of a 10% super tax imposed on the large-scale industry in a bid to shore up revenues for supporting the country's poor amid rising inflation. The benchmark KSE-100 index lost 1,665.18 points to conclude the day’s trade at 41,051.79, observing an intraday low of 40,555.41.

Investors reacted negatively to the announcement of the imposition of supertax and its impact will continue, Ahsan Mehanti, Director of Arif Habib Group said.

Fahad Rauf, Head of Research at Ismail Iqbal Securities told Mettis, “The tough calls are the need of the hour, however, burdening the existing taxpayers is not the way out.”

Meanwhile, the absence of fresh inflows and fast depleting foreign exchange reserves have further dented the investors’ confidence.

The Index traded in a range of 2241.54 points or 5.25 percent of previous close, showing an intraday high of 42,782.12 and a low of 40,540.58.

Of the 97 traded companies in the KSE100 Index 6 closed up 88 closed down, while 3 remained unchanged. Total volume traded for the index was 210.81 million shares.

Sector wise, the index was let down by Commercial Banks with 405 points, Oil & Gas Exploration Companies with 220 points, Fertilizer with 205 points, Cement with 193 points and Power Generation & Distribution with 108 points.

The most points taken off the index was by UBL which stripped the index of 96 points followed by HUBC with 94 points, ENGRO with 80 points, MCB with 78 points and LUCK with 73 points.

Sectors propping up the index were Insurance with 5 points.

The most points added to the index was by EFUG which contributed 12 points followed by MUREB with 1 point, ATLH with 1 point and KEL with 1 point.

All Share Volume increased by 74.74 Million to 424.23 Million Shares. Market Cap decreased by Rs.231.00 Billion.

Total companies traded were 364 compared to 347 from the previous session. Of the scrips traded 61 closed up, 287 closed down while 16 remained unchanged.

Total trades increased by 16,030 to 162,695.

Value Traded increased by 2.67 Billion to Rs.12.81 Billion

| Company | Volume |

|---|---|

| K-Electric | 36,666,500 |

| Cnergyico PK | 25,853,800 |

| Pakistan Refinery | 25,300,378 |

| Telecard | 16,907,500 |

| Unity Foods | 15,786,764 |

| Flying Cement Company | 15,202,000 |

| Worldcall Telecom | 14,912,000 |

| Hum Network | 12,404,000 |

| TPL Properties | 12,143,319 |

| Ghani Global Holdings | 10,087,763 |

| Sector | Volume |

|---|---|

| Technology & Communication | 66,753,954 |

| Power Generation & Distribution | 57,143,410 |

| Refinery | 55,871,093 |

| Cement | 36,381,805 |

| Food & Personal Care Products | 28,983,470 |

| Chemical | 28,521,062 |

| Commercial Banks | 25,368,586 |

| Oil & Gas Marketing Companies | 16,757,701 |

| Miscellaneous | 14,211,319 |

| Cable & Electrical Goods | 12,782,750 |

Copyright Mettis Link News

33706