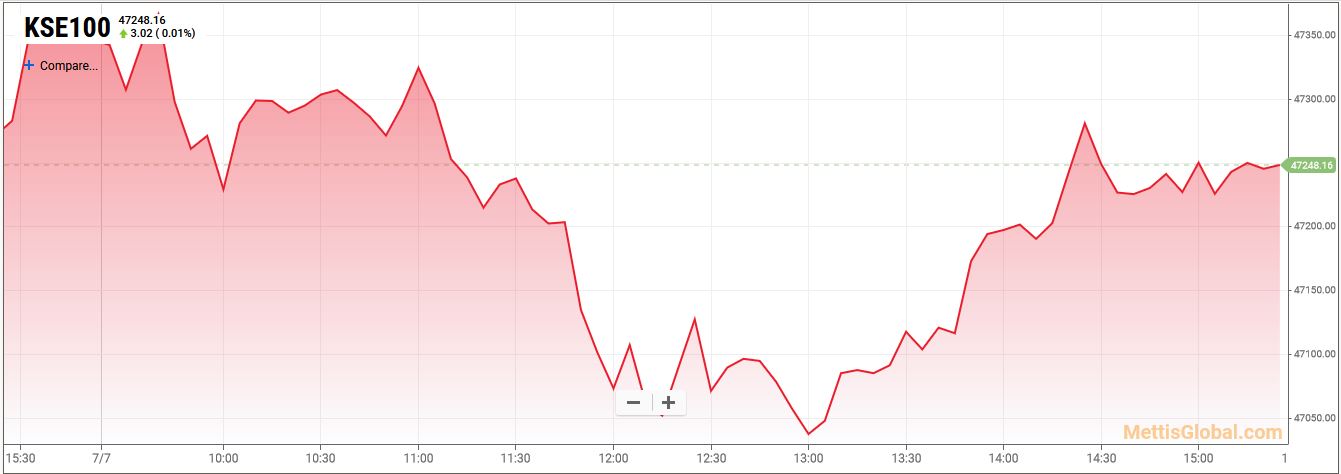

July 07, 2021 (MLN): The capital market on Wednesday witnessed a range bound activity at the start of the day with the benchmark KSE-100 Index making an intraday low of 311 points during the session as market sentiments continued to be weighed by the collection of capital gain tax, high commodity prices besides geopolitical conditions.

However, in the second half, the market witnessed some recovery as it chattered that NCCPL might agree to include June 2021 in CGT calculation, which will reduce payable as a lot of Investors booked losses in June to net off gains, a market closing note by Topline Securities highlighted.

Accordingly, the index ended the trading session with a 98.24 point or 0.21 percent decline to close at 47,247.92. This is the fourth day in a row that the index has closed in the red.

The Index traded in a range of 341.03 points or 0.72 percent of the previous close, showing an intraday high of 47,375.67 and a low of 47,034.64.

Of the 94 traded companies in the KSE100 Index, 32 closed up 58 closed down, while 4 remained unchanged. The total volume traded for the index was 158.29 million shares.

Sector-wise, the index was let down by Oil & Gas Exploration Companies with 52 points, Tobacco with 29 points, Cement with 20 points, Textile Composite with 11 points and Fertilizer with 11 points.

The most points taken off the index was by PAKT which stripped the index of 29 points followed by POL with 19 points, KOHC with 14 points, PPL with 12 points and BAHL with 12 points.

Sectors propping up the index were Technology & Communication with 25 points, Pharmaceuticals with 12 points, Commercial Banks with 9 points, Automobile Assembler with 7 points and Transport with 6 points.

The most points added to the index was by TRG which contributed 26 points followed by HBL with 25 points, AGP with 14 points, CHCC with 7 points and PIBTL with 6 points.

All Share Volume decreased by 129.10 Million to 412.20 Million Shares. Market Cap decreased by Rs.32.48 Billion.

Total companies traded were 412 compared to 413 from the previous session. Of the scrips traded 172 closed up, 222 closed down while 18 remained unchanged.

Total trades decreased by 26,882 to 133,170.

Value Traded decreased by 2.64 Billion to Rs.14.97 Billion

| Company | Volume |

|---|---|

| Fauji Foods | 41,177,000 |

| Worldcall Telecom | 30,164,000 |

| TPL Corp | 20,271,000 |

| Unity Foods | 16,625,400 |

| Hascol Petroleum | 16,160,305 |

| Byco Petroleum Pakistan | 16,110,000 |

| K-Electric | 15,037,500 |

| Fauji Fertilizer Bin Qasim | 14,779,500 |

| Silkbank | 9,964,000 |

| Pakistan International Bulk Terminal | 9,952,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 79,258,776 |

| Food & Personal Care Products | 73,145,880 |

| Commercial Banks | 26,022,731 |

| Cement | 23,784,904 |

| Refinery | 23,313,300 |

| Oil & Gas Marketing Companies | 23,198,959 |

| Power Generation & Distribution | 22,643,730 |

| Transport | 16,923,100 |

| Fertilizer | 16,068,035 |

| Miscellaneous | 13,828,600 |

Copyright Mettis Link News

42122