In the private republic of Pakistan, where everything from water to healthcare is available at market prices instead of being provided by the state institutions, an outsider would expect a high prevalence of insurance to compensate for the additional systemic risks. But alas! That is far from the case and as a country, we have one of the lowest insurance-to-GDP ratios at just around 1.1%, lagging behind the regional and emerging markets average.

Many Pakistani Muslims believe insurance to be haram. But then, similar views persist about banking yet it remains far more popular. The issue is more of a low financial inclusion and there, the relevant institutions, public or private, haven’t done a particularly good job. One ray of hope to all of this has been the emergence of Islamic banking, and to more limited extent insurance, into the mainstream.

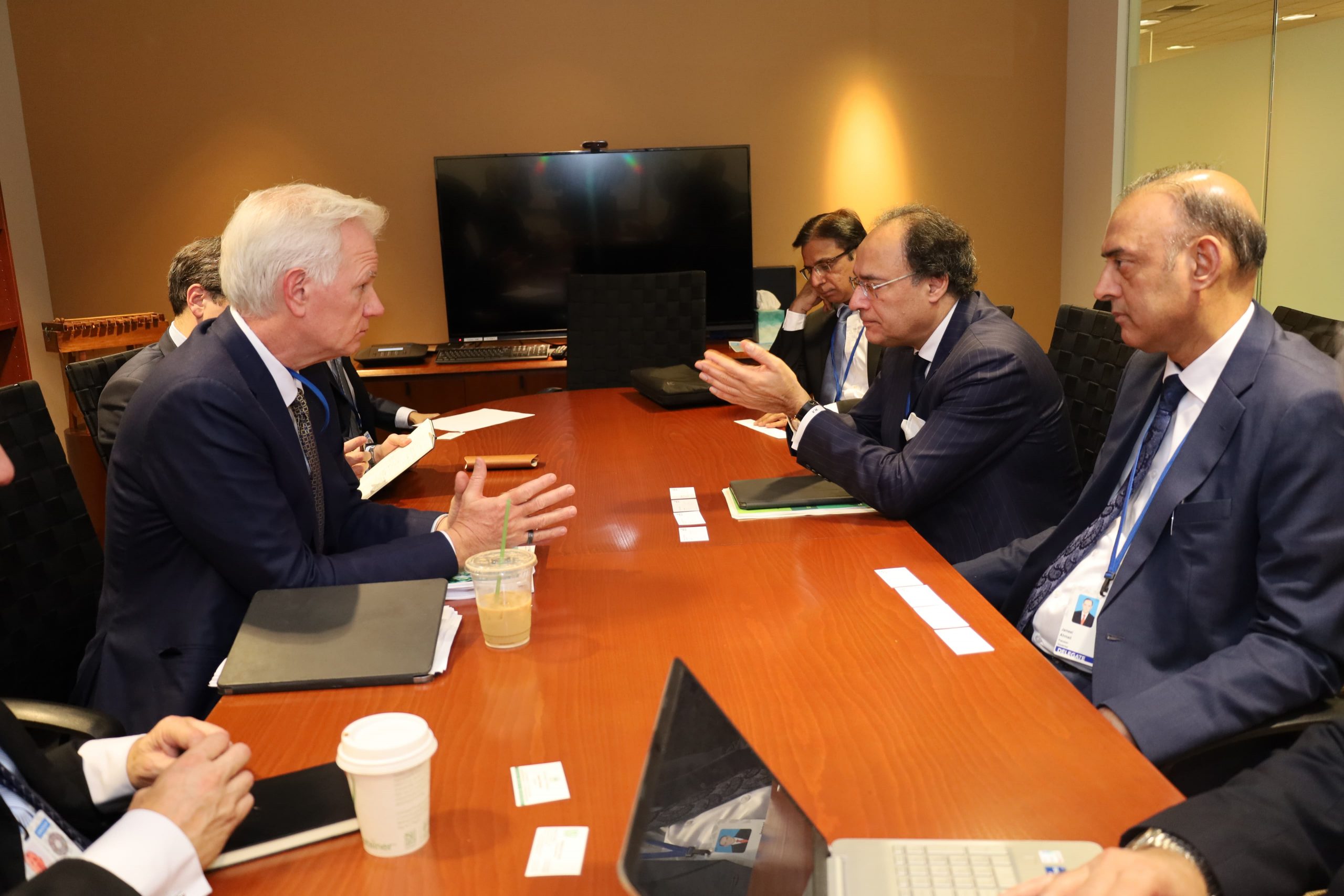

To better understand the latter, Takaful, MG interviewed Azim Pirani, the CEO of Pak-Qatar Family Takaful, easily the largest player in the segment. The edited excerpts below discuss the company’s financial performance, the overall industry, the business model among other things.

What trends did you guys notice in the wake of Covid-19? Was there a spike in demand?

AP: The bancatakaful business took a hit as banks were closed or doing limited operations but direct sales managed to do fairly well. It took a disease for people to wake up and realise the importance of insurance and we noticed more and more people calling us to inquire about life coverage. On the claims side, that of life’s were definitely higher while health noticed a decline as people were trying to avoid hospitals out of the fear of Covid-19.

Pak Qatar Family Takaful’s profit after tax declined significantly to Rs55 million in 2019, from Rs107m. Can you explain the reasons?

AP: This dip was due to the internal restructuring process that we initiated in late 2019 and concluded in early 2020. There were some systemic problems in our processes, particularly the direct sales department, from where a bulk of our costs and contributions come from. But now that it is complete, we have seen a significant impact of the entire process that will be reelected in the upcoming 2020 financial results.

What’s the overall market size of the takaful industry in Pakistan?

AP: Until window operations were introduced, Takaful was a very small market but since then, it really shot up. For example, Jubilee General hit the Rs1 billion mark in just the first year as many of its existing customers wanted to switch towards Takaful.

Let’s look at the most lucrative product in the insurance industry, both from the popularity and the recurring revenue perspective: savings and protection plan. Under that, Pak Qatar currently stands at number three, behind EFU and Jubilee. But their numbers include conventional insurance as well.

Accurate figures in our industry are very hard to find but based on the estimates, Takaful easily accounts for 15-20% of the overall insurance. For us, this has been led by our banca, which has been quite strong since the beginning and even now is competing with the big players. It makes penetration much easier since banks already have an existing footprint and you don’t need to incur the costs the same way as to direct sales by building your own infrastructure.

To expand on the market share, let me give you an example: last year, Adamjee Life did around Rs3bn of business through banca. Of that, almost Rs1.7bn was takaful. It has a couple of reasons: firstly, Takaful is also selling through conventional banks as some customers sometimes prefer this route over insurance. Secondly, the Islamic banks are growing, be it Faysal making a complete transition or others pacing up their Islamic operations.

However, our size becomes smaller when it comes to General, where the penetration of Takaful hasn’t been to the same extent as family. They are surviving, they are making money but haven’t really grown as rapidly.

What is it about family insurance which makes it much more popular?

AP: To start with, obviously family is a bigger company with a higher capitalization as well. It’s a cash cow, once you enter profitability, there is smooth sailing afterward. Whereas in general, the business needs to be built up every year from the start, which is extremely difficult.

What are the key drivers of your business line? Has there been any shift in their shares?

AP: In 2020, our new business through direct sales was around Rs1.2bn, which touched the Rs1bn-mark for the first time. Another Rs1.7bn came from corporate clientele while bancatakaful earned us Rs600-700m. The corresponding figures for the previous year were around Rs700m, Rs2bn and Rs800m, respectively. So there has been a move towards direct sales, which we hope will show even better results after the recent restructuring process.

The company’s net profitability ratios are quite thin, hovering between 1% and 2%. Is this an industry problem?

AP: Let’s break down the cost structure to understand this better: say we sell a policy with an annual contribution of Rs100,000. In the first year, around 35-40% of that amount will be paid as the commission to the sales agent, some 10-12% is our servicing fee, then a small share goes towards the participants’ fund to cover claims-related cash flows. The remaining amount is invested in the policyholders’ fund where the company also earns a Wakala fee for managing it.

So in the first year, we barely earn anything as the bulk of the amount goes in commissions. It’s only later on during the life of the policy that it starts becoming lucrative for us, and that keeps the ratios low. It’s more or less the same for the overall industry, except maybe for the players who have been in the business for a very long time and already have significant renewals.

Islamic financial services institutions have long complained about a lack of avenues to utilize their liquidity. Is it the same case for Pak Qatar?

AP: Islamic financial institutions have typically found the playing field in favor of conventional institutions, especially the banks. But that is now changing as things are improving liquidity wise, thanks to an increase in Sukuks. With Faysal Bank transitioning into a full-fledged Islamic bank, our options will further expand. We also have an actively managed equity portfolio which has done pretty well and beat all the benchmarks over the past two years.

Copyright Mettis Link News

39682