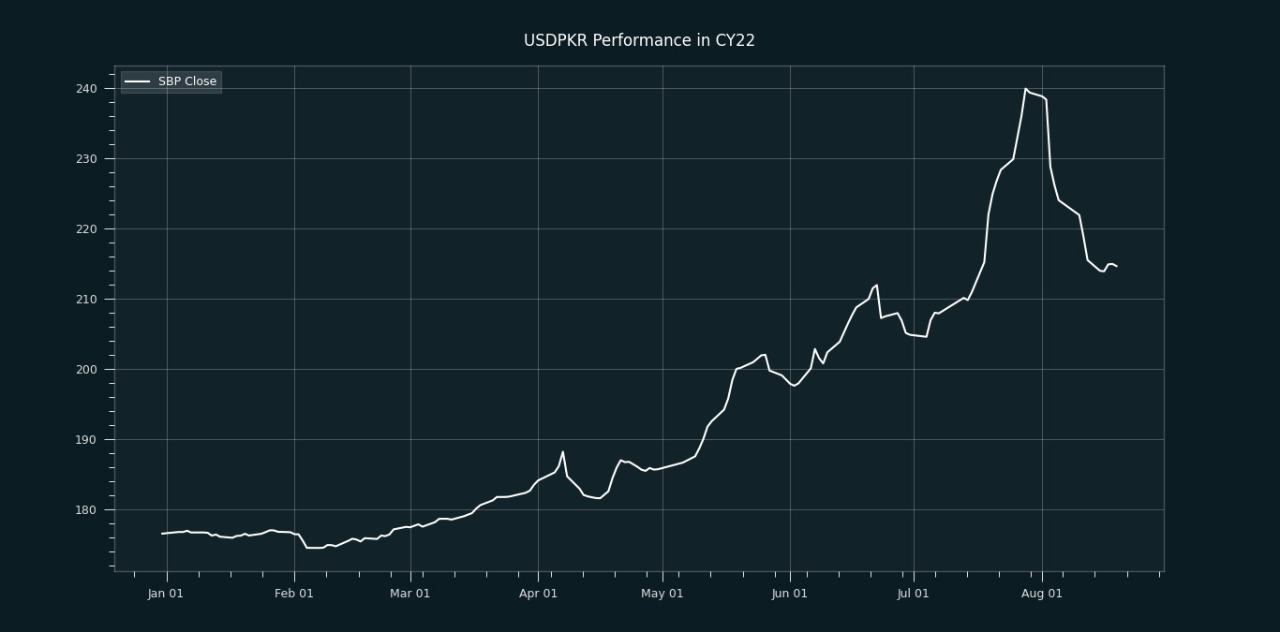

August 19, 2022 (MLN): In the backdrop of positive sentiments prevailing in the interbank market due to the upcoming IMF executive board meeting this month, the Pakistani rupee (PKR) managed to gain 84 paisa in five consecutive sessions as the currency closed the week’s trade at PKR 214.65 per USD.

Within today’s session, PKR appreciated by 30 paisa against the greenback while enduring a range-bound trading session with a band of 1.5 rupees per USD showing an intraday high of 215.50 and intraday low offer of 214.75. Meanwhile, in the open market, PKR was traded at 216/218.50 per USD.

After enduring a rough spell of depreciation in July 2022 due to uncertainties on political and dismal macros, the clarity on the IMF front after the statement by Dr. Esther Perez Ruiz, IMF’s Resident Representative for Pakistan wherein she mentioned that Pakistan had completed all prior actions for loan review, has come like a savior.

In addition to it, News flows pertaining to foreign exchange inflows from Saudi Arabia have strengthened the PKR rally in the interbank market. According to the Bloomberg report, the Saudi Finance Ministry is planning to renew its $3 billion deposit with the State Bank of Pakistan (SBP) as soon as this week.

The kingdom is also considering providing $100 million a month for 10 months in petroleum products that will be granted as additional support.

It is pertinent to mention that this development came during the crucial time when Pakistan is in dire need of foreign exchange, which will pave the way for IMF’s board approval at the end of August 2022.

The local unit has recovered by almost 12% within twelve consecutive sessions in August. However, PKR joined back its traditional course on the back of increasing demand for dollars as the government has allowed the imports of most products that were banned earlier to improve the USDPKR parity.

It is pertinent to mention that lost almost 95 paisa in two consecutive sessions.

Speaking to Mettis Global, Zafar Paracha, General Secretary of Exchange Company Association of Pakistan (ECAP) said that due to the increase in the USD rate in Afghanistan, the element of dollar smuggling has been activated once again which created unfair pressure on the local unit.

He requested the higher authorities and concerned departments to mitigate the element of smuggling and control the USD rate for stabilizing the economy.

On the other hand, Malik Boston, President of Forex Association of Pakistan said that there is no element of smuggling exists as the Afghanis who take dollars with them from Pakistan have dual nationality. Hence, they are allowed to carry a certain amount of dollars with them.

“Around 20 million USD is being transported from Pakistan to Afghanistan as its international accounts have been frozen,” he added.

In FYTD, PKR lost 9.8 rupees or 4.57%, while it plummeted by 38.13 rupees or 17.77% against the USD in CYTD, as per data compiled by Mettis Global.

.jpeg)

Meanwhile, the currency gained 2.9 rupees against the Pound Sterling as the day's closing quote stood at PKR 255.86 per GBP, while the previous session closed at PKR 258.74 per GBP.

Similarly, PKR's value strengthened by 1.9 rupees against EUR which closed at PKR 216.67 at the interbank today.

On another note, the State Bank of Pakistan (SBP) on Friday injected Rs862.35 billion into the money market through reverse repo purchase and Shariah-compliant mudarabah-based open market operation.

The overnight repo rate towards the close of the session was 15.70/15.90%, whereas the 1-week rate was 15.05/15.15%.

Copyright Mettis Link News

Posted on:2022-08-19T16:51:28+05:00

34689