June 29, 2022 (MLN): Riding on the upward trail, the Pakistani rupee (PKR) has appreciated by 1.8 rupees against the US dollar in today's interbank session as the currency settled the trade at PKR 205.12 compared to the previous closing of 206.87 per USD.

During the session, the rupee traded in a range of 1.3 rupees per USD showing an intraday high bid of 205.60 and an intraday low offer of 204.80 while in the open market, PKR was traded at 203.50/205.50 per USD.

The positive sentiments stemmed in the market after Pakistan received the Memorandum of Economic and Financial Policies (MEFP) wherein the fund set four tough conditions to revive stalled $6 billion loan program.

This includes an increase in electricity tariffs, imposing a levy on petroleum products, ending the government’s role in determining the oil prices, and setting up an anti-corruption task force to review all the existing laws that were aimed at curbing graft in the government departments.

After implementing the conditions, the IMF would present Pakistan’s request for the approval of the loan tranche and revival of the program to its executive board – a process that may consume another month, the sources said, quoted Tribune.

Meanwhile, the National Assembly on Wednesday passed the Finance Bill-2022 after clause-by-clause consideration and adopting certain amendments in it.

Minister of State for Finance and Revenue Aisha Ghaus Pasha moved the motion for consideration of the Finance Bill, 2022 to give effect to the financial proposals of the federal government for the year beginning on July 1, 2022.

During the debate on the Finance Bill, Aisha Ghaus Pasha said there had been no pressure from the International Monetary Fund (IMF) to integrate amendments in the federal budget 2022-23 saying that the changes had been made in the larger interest of the country, reported by APP.

The amendments were made in such a way that the common man should not be affected, she said adding that the government had reduced taxes on the people having small incomes while increasing tax on the higher-income people.

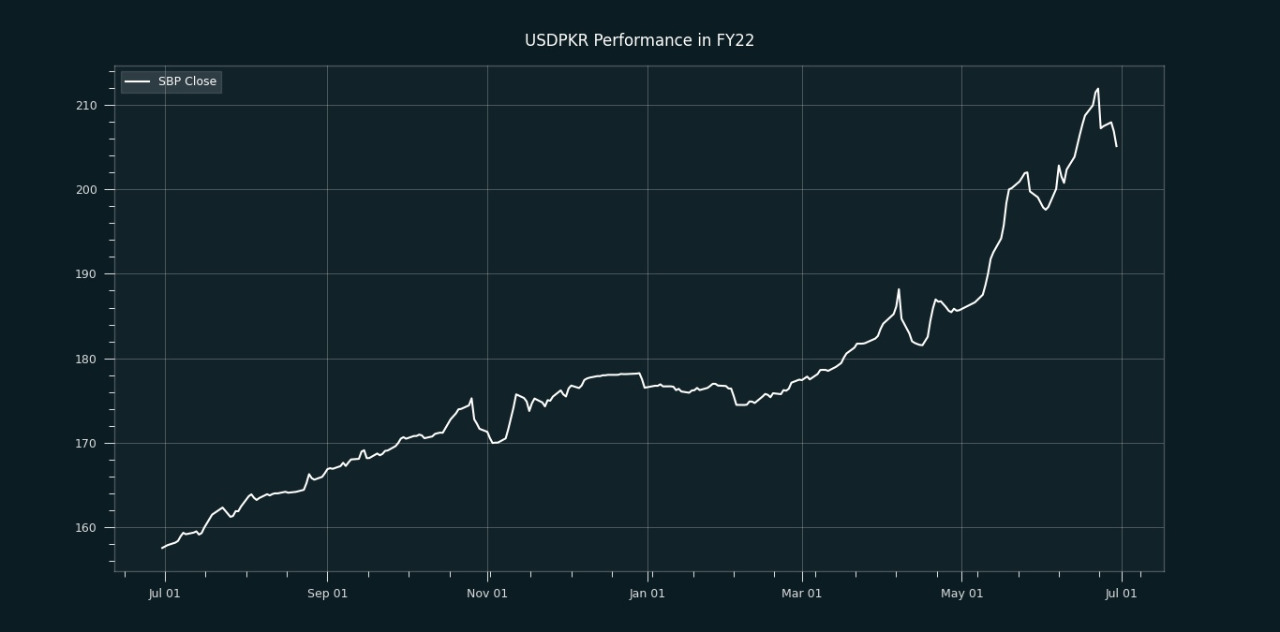

From July’21 to date, the local unit has lost Rs48.57 against the USD. Similarly, the rupee fell by Rs28.6 in CY21, with the month-to-date (MTD) position showing a decline of 3.24%, as per data compiled by Mettis Global.

During the last 52 weeks, PKR lost 23.19% against the greenback while reaching its lowest at 211.93 on June 22, 2022, and the highest of 157.54 on June 30, 2021.

Furthermore, the local unit has weakened by 13.38% since its high on July 02, 2021, against EUR while, it has dropped by 13.10% against GBP since its high on July 02, 2021.

The performance of the local unit remained bleak against other major currencies in one month as the currency weakened by 2.95%, 2.94%, 2.92%, 2.21%, and 0.77% against AED, CHF, SAR, CNY, and EUR, respectively. on the other hand, the domestic unit appreciated by 3.79% and 0.53% against JPY and GBP, respectively.

.jpeg)

The currency gained 4 rupees against the Pound Sterling as the day's closing quote stood at PKR 250.04 per GBP, while the previous session closed at PKR 253.99 per GBP.

Similarly, PKR's value strengthened by 3.4 rupees against EUR which closed at PKR 215.64 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 12.75/12.80 percent, whereas the 1-week rate was 12.95/13.05 percent.

Copyright Mettis Link News

33804