July 06, 2022: National Investment Trust Limited (NITL) has declared its annual results for its funds under management for the year ended June 30, 2022.

NITL has distributed a total dividend of over Rs4.77 billion for the year FY22 representing an impressive 73% growth over the previous year. Mr. Adnan Afridi MD NITL, said that all of the fixed income and money market funds performed well and have generated competitive returns during the year.

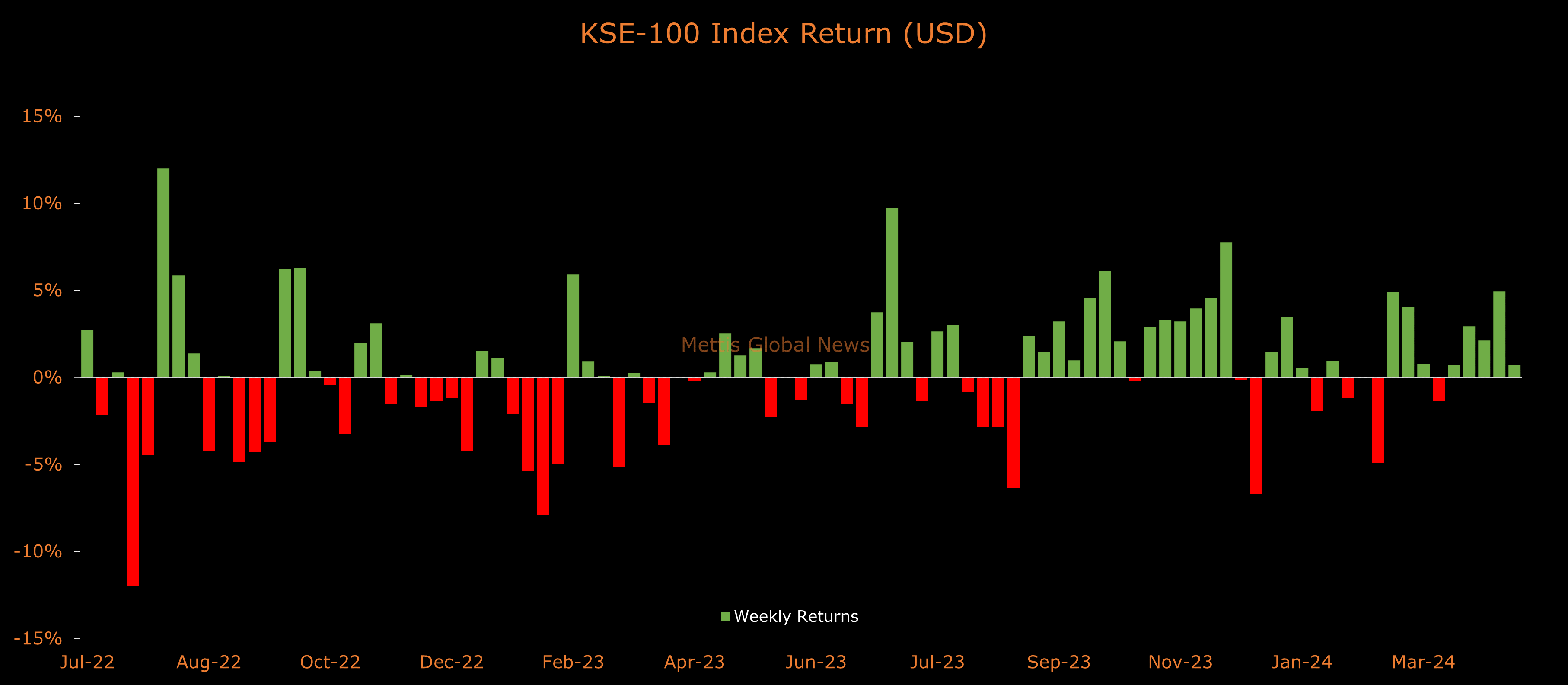

However, due to the economic and political uncertainties overall stock market (KSE – 100 index) declined by 12% in FY22, similarly our equity funds performed in line with the market.

He said in pursuance of our objective to offer diversification to our unit holders through innovative products, NITL launched NIT Social Impact Fund (NIT – SIF) and NIT Islamic Money Market Fund (NIT- IMMF) in FY22. NIT Social Impact Fund (NIT – SIF) is an open-end Micro Finance Sector-Specific Income Fund that shall channel funds for financial returns and sustainable social impact.

NIT Islamic Money Market Fund would provide a competitive return by primarily investing in low-risk and highly liquid Shariah Compliant Money Market & Debt Instruments. He further said that NITL is in process of launching the NIT Pakistan Technology ETF which will be the first-ever IT Sector ETF in Pakistan.

He said that during the year 2021-22 NITL has maintained the highest asset manager rating of AM1 by accredited rating agencies, PACRA and VIS Credit Rating Co. Ltd. This is the top-quality asset management rating for asset management companies.

Adnan Afridi hoped that the unitholders would continue to invest in trust and allow NITL management to manage their portfolios.

NI(U)T Fund

Despite challenging macroeconomic and market conditions, NIT has maintained its 59 years history of consistently paying dividends and declared a cash dividend of Rs2.44 per unit for unitholders of NI(U)T Fund against the dividend of Rs. 1.61 last year i.e., an increase of 51.56% from last year. The payment of dividends @ Rs2.44 per unit translates to a payout of Rs2.00 billion among its unit holders.

NIT Money Market Fund (NIT MMF):

During FY22, NITL paid a cumulative per unit cash dividend of Rs. 0.9789 for unitholders of NIT Money Market Fund in the form of twelve interim payouts.

During the year under review, the Fund yielded an annualized return of 10.79% p.a. compared to the benchmark return of 9.28% p.a., an outperformance of 1.51%. During FY22 net assets of NIT Money Market Fund grew by almost 51% to Rs18,592 million as of 30th June 2022 as compared to Rs12,302 million as of June 30, 2021.

NIT Islamic Money Market Fund (NIT IMMF):

From its launch on September 23, 2021, till 30th June 2022, NITL paid a cumulative per unit cash dividend of Rs7.3553 for unitholders of NIT Islamic Money Market Fund in the form of interim payouts.

During the year under review, the Fund yielded an annualized return of 10.23% p.a. compared to the benchmark return of 3.78% p.a. an outperformance by 6.45%. Net assets of NIT Islamic Money Market Fund stood at Rs2,603 million as of 30th June 2022.

NIT Islamic Income Fund (NIT- IIF):

NIT has declared a per-unit cash dividend of Rs. 0.8374 for unitholders of NIT Islamic Income Fund for the year ended on 30th June 2022. During FY22, the Fund generated an annualized return of 9.67% p.a. compared to the benchmark return of 3.34% p.a. hence posted a significant outperformance of 6.33%. As of 30th June 2022, the net assets of the Fund stood at Rs. 830 million.

NIT Income Fund (NIT-IF):

NIT has declared a cash dividend of Rs. 1.0339 per unit for unitholders of NIT Income Fund for the year ended on 30th June 2022. During FY22, NIT-IF yielded an annualized return of 10.64% p.a. The net assets of the fund stood at Rs 3,716 million as of June 2022.

NIT Government Bond Fund (NIT-GBF):

NIT has declared a per-unit cash dividend of Rs. 0.8753 for unitholders of NIT GBF for the year ended on 30th June 2022. During FY22, NIT GBF yielded an annualized return of 9.32% p.a. The net assets of the fund stood at Rs 3,008 million as of June 2022.

NIT – Equity Market Opportunity Fund (NIT-EMOF)

NIT has declared a per-unit cash dividend of Rs. 10.00 for unitholders of NIT Equity Market Opportunity Fund for the year ended on 30th June 2022. During FY22, the Net Asset of the Fund stood at Rs 6,818 million as of June 30, 2022.

NIT – Islamic Equity Fund (NIT-IEF)

NIT has declared a per-unit cash dividend of Rs. 0.35 for unitholders of NIT Islamic Equity Fund for the year ended on June 30, 2022. During FY22, the net assets of the fund stood at Rs 2,574 million.

NIT-State Enterprise Fund (NIT-SEF)

NIT has declared a cash dividend of Rs. 0.64 per unit for unitholders of NIT-State Enterprise Fund for the year ended on June 30, 2022. The net assets of the fund stood at Rs 1,257 million as on June 30, 2022.

NIT-Social Impact Fund (NIT-SIF)

NIT has declared a cash dividend of Rs. 0.1615 per unit for unitholders of the NIT-Social Impact Fund for the year ended on June 30, 2022. During FY22, NIT-SIF yielded an annualized return of 14.93% p.a. The net assets of the fund stood at Rs 735.22 million as of June 30, 2022.

Press Release

33950