June 01, 2022 (MLN): Despite a change in political set-up along with ongoing monetary adjustments, the Pakistan stock market is still not out of woods yet as the investors are eagerly anticipating the announcement of IMF agreement which will not only allow the country to unlock further avenues for loans from friendly countries and help meet its maturing debt liabilities but will also help instill confidence in the market.

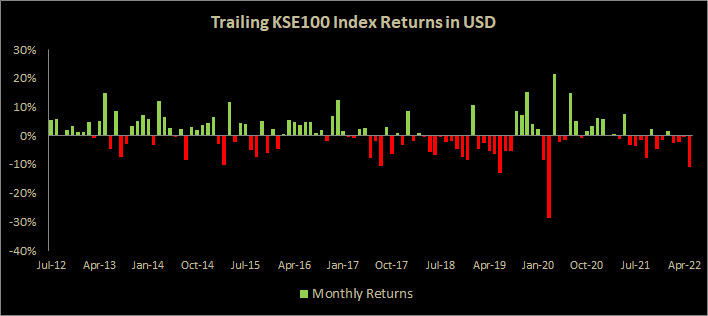

The performance of the market during May'22 shows that the benchmark KSE-100 index has endured a bruising month, which wiped out the total gains made in 4MCY22, losing sharp 2,171 points or 4.8% MoM to close a rocky month at the 43,078 level.

This was the worst monthly index performance since Sep’21 when the index return declined by 5.3%MoM. With this, the returns for 5MCY22 stand at -3.4%. In USD terms, the index was down by 11% MoM as the PKR depreciated by 6.6% against the USD in May’22.

The underperformance of the index during the month underscored the concerns about delay in the IMF loan program and Saudi Arabian aid package, raging political turmoil, new taxes in next the fiscal year budget 2022-23, and a rise in economic crisis as the soaring trade deficit, huge external debt servicing and rapid reserve depletion is making the investors jittery.

Adding to the woes were increase in policy rate to 13.75% to reduce demand and anchor inflation and the persistent depreciation of the PKR against the USD which reduced investors' buoyancy as the rupee made a new low of Rs202/USD as of May 26, 2022.

Overall, the market witnessed 11 bullish and 7 bearish sessions. The average traded volume of the KSE All index during the month decreased by 13%MoM to 252mn shares while the average daily traded value dropped to Rs7.2bn, down by 12% MoM. Accordingly, the market capitalization of the KSE-ALL Index decreased by 5%MoM to Rs7.136 trillion during the month compared to Rs7.5tr recorded last month.

From the sector-specific lens, the major underperforming sectors during the month were Banks (-626 points), Cement (– 527 points), Fertilizer (-263 points), Technology (-161 points), and Oil & Gas Exploration Companies (-122 points).

On the flip side, the sectors that were able to outperform the benchmark index were Automobile (107 points), Chemical (29 points), and Sugar (3 points).

Scrip-wise, LUCK, SYS, EFERT, MCB, and HBL underperformed during the month as they took away 269, 196, 128, 126, and 100 points from the index respectively, whereas MTL, POL, LOTCHEM, TRG, and MUREB were the best performing securities during May 2022, cumulatively adding 305 points to the index.

On the NCCPL front, aggressive foreign selling continued during the month as foreigners offloaded $8.8mn worth of securities from the equity market, taking cumulative outflow during 11MFY22 to $285mn. The majority of the selling during the month was witnessed in Banks ($6.4mn), and Cement ($4.8mn).

On the local side, the majority of the selling was absorbed by Banks, Individuals, and Organizations amounting to $31.7mn, $5.3mn, and $3.2mn respectively. However, Mutual Funds and Insurance companies stood on the other side with net selling of $20.4mn and $12.4mn respectively.

Month Ahead

Though much of the impact of the unwinding of fuel and electricity price subsidies, and the resulting rise in inflation has already been priced in by the investors, the market will have plenty to worry about in the month of June’22 as the political noise is expected to remain heightened till the elections, making it difficult for the government to roll out subsidies and meet fiscal targets as agreed with the IMF.

“It is difficult for this short tenure government to carry out economic or structural reforms necessary to bring economic stability in the longer run,” analyst at Foundation Securities said.

Moreover, calling for another long march or sit-ins by the ousted PM Imran Khan, post-deadline for initiation of General Elections, will likely induce selling pressure in the PSX.

Additionally, higher inflation followed by higher electricity and fuel prices may persuade SBP to take stern measures in controlling inflationary pressures by hiking further borrowing rates for EFF and LTFF along with policy rates in the next MPC.

The market will also track the budget announcement closely where the government is expected to announce a tax collection target of Rs7.1 trillion, in consultation with IMF. Budgetary spending will also likely be adjusted downwards in order to contain the fiscal slippages, analyst at AKD Securities said.

Copyright Mettis Link News

33114