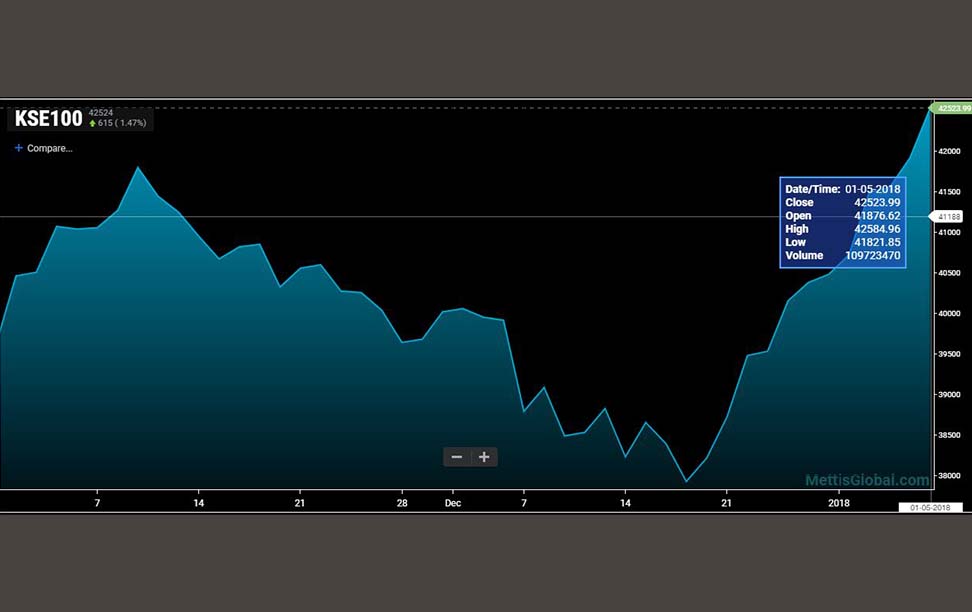

KSE – 100 index may turned a different leaf in the book as the year 2018 begins with a bang. The index ignored all of the negativities, and instead chose to bank on the positivity signs. Political certainty, Chinese support against Trump’s tirade, attractive valuations on the back of stable exchange rate helped index gain 5.07% during the week; 7th largest points increase.

Bulls took charge of the market during the week as the continued positive momentum for the last 12 days have helped the index regain some of the lost points during the second half of the year 2017. Attractive valuations and the stable exchange rate has prompted Foreign Investors to resume buying in the index. Foreign Investors bought equities worth $ 23 million during the week against $ 9 million previous week.

HBL +284.7, UBL +227.3, LUCK +153.7, OGDC +96.8, PPL +89.3, FFC +79.1, ENGRO +71.2, BAHL +67.4, DGKC +49.2 and DAWH +49.00 contributed most of the index points during the week collectively adding 1167.7 points. The top five losers of the week, which took away 83 points from the index, are as follows: ABOT -22.5, PMPK -10.2, COLG -9.9, NCPL -9.4 and NATF -9.2 stocks.

The major foreign exposure came in the Cements, Commercial Banks, and Exploration and Production front with a total buying these sectors clocking in at $ 15.3 million.

Pakistan Bureau of Statistics released the inflation figures for the month of December. The inflation clocked in at 4.57% during the month, with Sensitivity Price Index (SPI) decreasing by 0.31. With inflationary pressure set reverberate the economy in coming months, as inflation rises on the back of rising oil prices, and exchange rate fluctuations, analysts expect the Central Bank to raise rates in the coming months.

Furthermore, on agricultural front year on year Cotton Production increased by more than 7% during 2017. With a significant chunk coming from Punjab, Sindh also posted modest growth against the last year.

NCCPL Data

Investor Wise Data – Last Week

Sector Wise Data – Last Week

Weekly Reserves

According to figures released by the Central Bank, Pakistan's total FX Reserves on Dec 22, 2017 were USD 20.189 Billion.

|

Summary of Holding and Weekly Change |

||||

|---|---|---|---|---|

|

Foreign reserves held by |

Dec 22, 2017 |

Dec 15, 2017 |

Change |

% Change |

|

State Bank of Pakistan |

14,133.30 |

14,332.20 |

-198.90 |

-1.39% |

|

Net Foreign Reserves Held by Banks |

6,055.70 |

6,051.20 |

4.50 |

0.07% |

|

Total Liquid Foreign Reserves |

20,189.00 |

20,383.40 |

-194.40 |

-0.95% |

During the week, SBP's reserves decreased by US$199 million due to external debt and other official payments.

Weekly SPI

According to figures released by the Pakistan Bureau of Statistics, weekly SPI for the combined group decreased by 0.31% compared to the previous week (Dec 28, 2017), meanwhile registering an increase of 3.47% compared to the corresponding period (Jan 05, 2017) last year.

|

Sensitive Price Indicator Summary |

|||

|---|---|---|---|

|

Index |

Jan 04, 2018 |

Dec 28, 2017 |

% Change |

|

SPI Combined |

225.39 |

226.09 |

-0.31% |

Of the 15 items monitored, the average weekly price of 14 items registered an increase, 24 decreased while 31 remained unchanged.

Weekly Oil Prices – WTI & BRENT

Oil prices fell back on Friday during early trading after posting strong gains for much of the week. The tension in Iran has helped push prices up, and a strong U.S. crude inventory drawdown added some momentum on Thursday, although that bullish data was slightly offset by the large build in gasoline stocks. Overall, by Friday, it appeared that oil traders had sold off some positions to pocket some of the recent gains. The breather raises questions about the durability of the current rally.

|

Weekly WTI & Brent Prices |

|||||

|---|---|---|---|---|---|

|

Benchmark |

Jan 1, 2018 |

Jan 2, 2018 |

Jan 3, 2018 |

Jan 4, 2018 |

Jan 5, 2018 |

|

WTI |

– |

60.37 |

61.63 |

61.98 |

61.48 |

|

BRENT |

– |

66.13 |

67.29 |

67.51 |

67.10 |

WTI Week Wise

BRENT Week Wise