February 1, 2022 (MLN): Fauji Fertilizer Bin Qasim Limited (PSX: FFBL) is in talks with both local and foreign firms and evaluating different options like divestment of Fauji Meat Limited (FML) along with a reduction in losses, the management of the company informed while holding a corporate briefing session on Monday.

Meanwhile, the company loss from FML decreased by 27% YoY to Rs1.1bn in CY21, it added.

The management of the company is expecting strong dividends from PMP and AKBL in future given improvement in the business dynamics of these subsidiaries. Furthermore, DAP margins are likely to remain healthy along with better gas availability in 1QCY22.

Commenting on Fauji Foods Limited (FFL)’s performance, management stated that FFL operations are improving and expected to remain on a positive trajectory due to improvement in EBITDA on the back of increasing sales amid a recovery in market share of tea whitener and UHT segment, briefing takeaways covered by Foundation Securities noted.

Management also informed that FFL introduced new products which also strengthen the topline.

Apprising investors on the financial performance of the company during 2021 as per which the bottom line of the company saw a remarkable increase of around 60% to clock in at Rs9.22 billion compared to Rs6.03bn.

This splendid performance is mainly due to increased DAP sale price, higher other income due to increase in the share of profit from associated company AKBK and joint venture PMP coupled with lower finance cost amid lower mark-up rates.

The top line of the company noted a surge of 34% to stand at Rs128bn during the year as compared to Rs98bn in the previous year due to the hike in DAP prices. Resultantly, the gross margins of the company during the said period scaled up from 19% to 23%.

FFBL UREA/DAP offtake clocked in at 501/790K tons in CY21. To highlight, FFBL DAP production increased by 7% YoY to 790K tons in CY21 due to better gas supplies which allowed it to maintain its market share in DAP market at 42% in CY21, it added.

However, due to the decline in Urea production FFBL market share in Urea declined by 1ppt to 8% in CY21. Industry sales of DAP declined 14% YoY in CY21 to 1.88mn tons due to higher prices, however, DAP imports increased by 17% YoY due to lower inventory at the beginning of the year.

The management further informed that global DAP prices continued to increase considerably as compared to last year due to due to export restrictions in China, increase in raw material prices and higher demand by importing countries in CY21.

In addition, the management also highlighted that the company is in touch with the government for natural gas availability. The company normally undergoes Annual Turnaround (ATA) in the month of January. However, given the availability of gas, the company has delayed ATA for a few months.

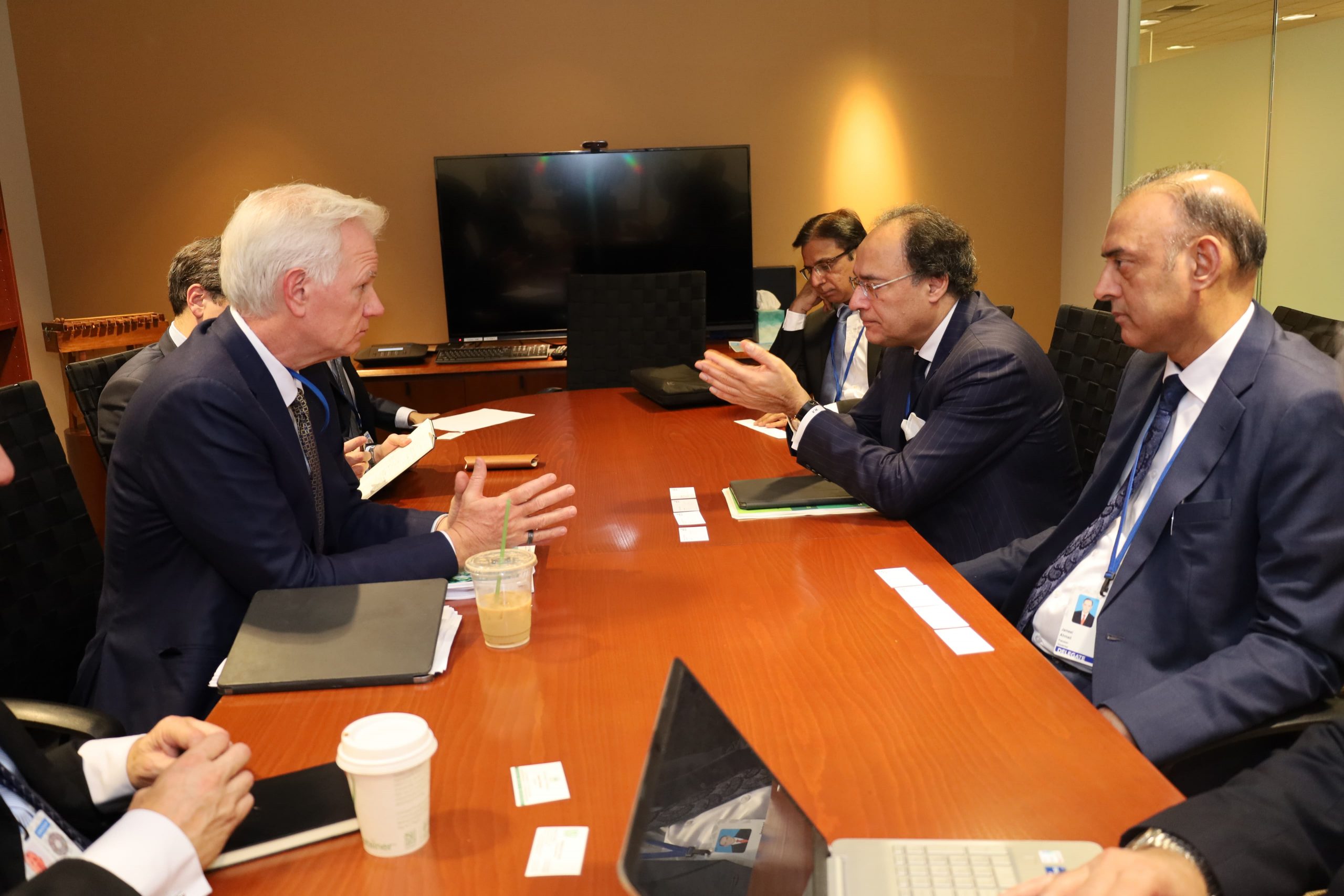

Moreover, the company is in discussion with the Finance Minister regarding the issue of long outstanding GST refunds which will be resolved by June 2022.

Copyright Mettis Link News

30526