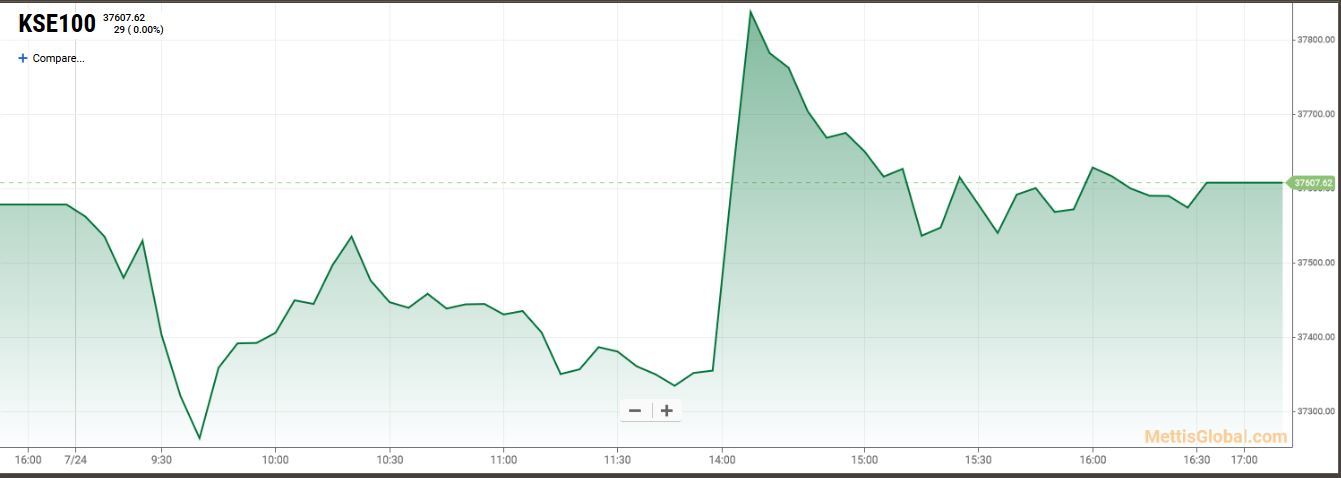

July 24, 2020 (MLN): Domestic equities witnessed mixed trend today. Market opened on a negative note as it surrendered to the profit-taking activity by risk-averse investors, however, it managed to gain momentum gradually during the second half, courtesy of HBL results which was above the market expectations.

According to a report by Arif Habib Limited, this turned the tide for the whole banking sector, resulting in HBL trading at upper circuit followed by UBL.

Consequently, KSE-100 index ended the session into bull’s territory with a gain of just 29 points and closed the day at 37,607 points. This was 0.08% higher compared to yesterday’s closing.

The Index traded in a range of 604.18 points or 1.61 percent of previous close, showing an intraday high of 37,863.35 and a low of 37,259.17.

Of the 94 traded companies in the KSE100 Index 37 closed up 56 closed down, while 1 remained unchanged. Total volume traded for the index was 189.85 million shares.

Sectors propping up the index were Commercial Banks with 217 points, Inv. Banks / Inv. Cos. / Securities Cos. with 21 points, Technology & Communication with 6 points, Food & Personal Care Products with 3 points and Automobile Assembler with 1 points.

The most points added to the index was by HBL which contributed 82 points followed by UBL with 43 points, MCB with 25 points, BAFL with 22 points and DAWH with 22 points.

Sector wise, the index was let down by Oil & Gas Exploration Companies with 55 points, Cement with 48 points, Power Generation & Distribution with 38 points, Oil & Gas Marketing Companies with 27 points and Pharmaceuticals with 9 points.

The most points taken off the index was by HUBC which stripped the index of 29 points followed by LUCK with 26 points, OGDC with 21 points, PPL with 13 points and POL with 11 points.

All Share Volume decreased by 112.75 Million to 266.53 Million Shares. Market Cap decreased by Rs.11.89 Billion.

Total companies traded were 373 compared to 403 from the previous session. Of the scrips traded 158 closed up, 201 closed down while 14 remained unchanged.

Total trades decreased by 38,703 to 105,337.

Value Traded decreased by 3.40 Billion to Rs.10.69 Billion

| Company | Volume |

|---|---|

| Unity Foods | 21,638,500 |

| K-Electric | 16,837,500 |

| Fauji Fertilizer Bin Qasim | 15,834,000 |

| Hascol Petroleum | 13,885,000 |

| TRG Pakistan | 13,718,000 |

| Fauji Foods | 12,663,500 |

| Pak Elektron | 8,992,000 |

| Habib Bank | 8,339,975 |

| The Bank of Punjab | 8,244,000 |

| Maple Leaf Cement Factory | 7,137,000 |

| Sector | Volume |

|---|---|

| Commercial Banks | 33,363,326 |

| Power Generation & Distribution | 24,244,963 |

| Cement | 24,099,999 |

| Technology & Communication | 23,331,100 |

| Vanaspati & Allied Industries | 21,638,700 |

| Oil & Gas Marketing Companies | 20,549,002 |

| Fertilizer | 17,404,655 |

| Chemical | 15,077,337 |

| Food & Personal Care Products | 15,000,660 |

| Cable & Electrical Goods | 9,597,800 |

Copyright Mettis Link News

35955