September 13, 2022 (MLN): Asia-Pacific (APAC) corporates are likely to shift to local financing as more restrictive monetary policy in the US widens the cost differential between onshore and offshore borrowings, says Fitch Ratings in its latest report issued today.

This is based on the assumption that US policy rates will rise at a more aggressive pace than local policy rates, the rating agency said.

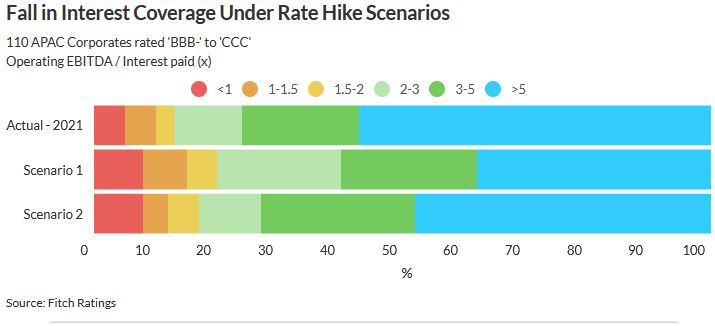

The analysis which is based on 110 APAC corporates rated between ‘BBB-’ and ‘CCC’, excluding Chinese homebuilders, shows that 20% of issuers will have an operating EBITDA/interest coverage ratio of below 2.0x under a scenario where they maintain the current funding mix.

However, a second hypothetical scenario where the corporates immediately switch to 100% onshore funding, if presented as a cheaper channel, would reduce the percentage to 17%.

This suggests that issuers are likely to curtail offshore borrowings to control costs, the report said.

“Our scenario analysis is, however, agnostic to fixed and floating rates, the presence of hedges or potential foreign-exchange movements”, Fitch said.

Fitch expects below-investment-grade corporates to benefit the most from a move to onshoring funding, as their interest coverage ratios will deteriorate less markedly under the second scenario.

Generally ample banking system liquidity in many APAC emerging markets would support this. Still, eight high-yield corporates face an elevated risk of interest coverage of below 1.0x even under this scenario and another six risk having their metrics weaken to the next 1.0x-1.5x and 1.5x-2.0x ranges.

Fitch noted that rising rates will hit issuers with shorter-dated debt harder, particularly those with lower ratings should a tightening in credit markets restrict funding access.

“However, we estimate that the proportion of total debt, including offshore bonds maturing in the next year, is modest for the 14 most vulnerable corporates on interest coverage, limiting their near-term refinancing needs”, it said.

The rating agency also expects that most of the 110 corporates will be able to adequately cover their interest costs, as China and Japan’s less restrictive monetary settings should ease strains for some issuers.

The portfolio’s average coverage would fall from 6.2x to 4.6x and 5.4x under the two scenarios, respectively, with a majority keeping their metrics at above 3.0x, it added.

Copyright Mettis Link News

Posted on:2022-09-13T13:57:27+05:00

35066